Eagle Eye Networks unveils cloud video surveillance camera report Second annual report provides global insight into cloud video surveillance use across hundreds of industries and camera manuf

By SSN Staff

Updated 9:53 AM CDT, Thu May 26, 2022

AUSTIN, Texas—Eagle Eye Networks, a global leader in cloud video surveillance and artificial intelligence (AI), released its second annual Cloud Video Surveillance Camera Worldwide Statistics report, delivering data and insight into security camera usage and trends globally and regionally.

The report analyzes aggregate data from a sample set of 200,000 cameras, including more than 150 camera manufacturers. The report covers a wide range of industries including corporate enterprises, retail, restaurant, warehouse, industrial, education, healthcare, hospitality, and multifamily dwellings.

“Organizations moving to cloud-based video surveillance make key deployment decisions across several factors,” said Dean Drako, Founder and CEO of Eagle Eye Networks. “We are sharing the most common implementation configurations and trends with a goal to help everyone moving to cloud security camera systems make better decisions.”

He added, “In addition to an organization deciding on the number and locations of their security cameras, they must make choices along several other factors. One goal of this report is to offer context for organizations making those determinations, by identifying the most common configurations and the trends over time.”

Key data includes:

- Increased adoption of higher resolution cameras, audio-enabled cameras, and regional differences in usage across the Americas, EMEA and APAC

- Relative level of use of the four most common video analytics

- Flexibility of true cloud systems to support hundreds of camera types and manufacturers around the world

- Growth in number of camera manufacturers

- Preferred video recording location and recording retention duration

- Regulated industries’ usage of cloud video surveillance

Top Camera Manufacturers

Once again, the report identified the top 10 camera manufacturers, which Eagle Eye said account for 87 percent of the installed third-party cameras, down from 90 percent last year. The top 10 list for 2021:

- Avigilon

- Axis

- Dahua

- Hanwha

- Hikvision

- LTS

- Mobitix

- Speco

- Tyco

- Vivotek

Video Recording Location

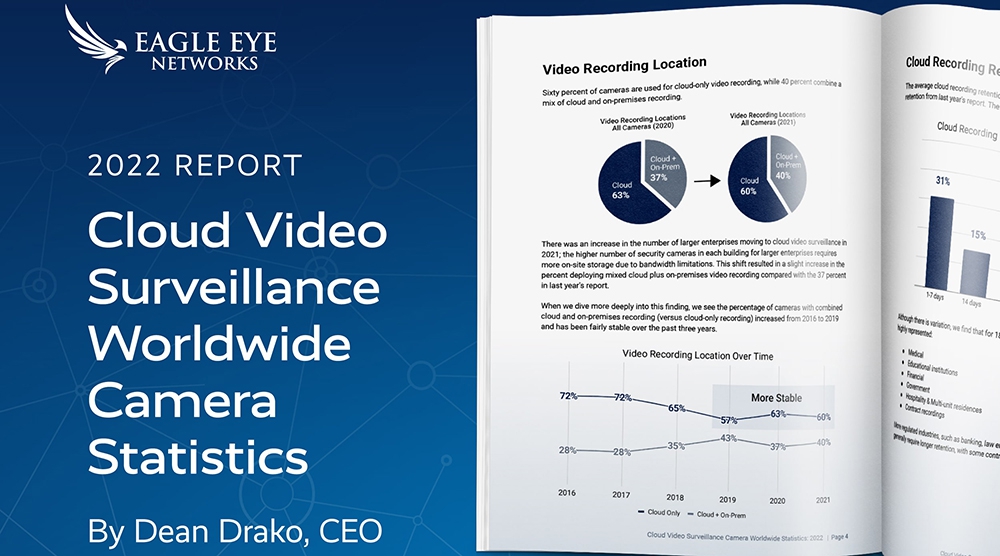

The report found that 60 percent of cameras are used for cloud-only video recording, while 40 percent combine a mix of cloud and on-premises recording.

“There was an increase in the number of larger enterprises moving to cloud video surveillance in 2021,” the report noted. “The higher number of security cameras in each building for larger enterprises requires more on-site storage due to bandwidth limitations.”

This shift resulted in a slight increase in the percent deploying mixed cloud plus on-premises video recording compared with the 37 percent in last year's report, Eagle Eye said, noting, “When we dive more deeply into this finding, we see the percentage of cameras with combined cloud and on-premises recording (versus cloud-only recording) increased from 2016 to 2019 and has been fairly stable over the past three years.”

Cloud vs. On-Premises Recording Retention

The average cloud recording retention in 2021 is 29 days, only slightly higher than the 28.2 cloud retention from last year's report, with the most common cloud retention of 30 days.

The average on-premises recording retention was stable this year at 33 days. The dominant retention choice continues to be 30 to 60 days, with 78 percent selecting that option. (In the 2021 report it was 72 percent.)

Digital Camera Resolution

Eagle Eye noted there has been a three-fold increase in high resolution digital security cameras over the past five years, driven in part by increased affordability, adding, “As the resolution increases, the ability to implement certain artificial intelligence (AI) solutions also increase.”

Analytics

This year, crossing analytics caught up with intrusion for a two-way tie for the most deployed analytics, closely followed by counting analytics, the report found. Loitering remained the least-used application, with deployment one-third or less of the others.

“The more recent artificial intelligence-based analytics available in the market, including license plate recognition and traffic monitoring, are still in earlier stages of adoption and do not yet show up to a significant level,” the report noted.

Click here for the full report and closer look at the findings.

Comments