Okta innovations to help companies harden security posture

By SSN Staff

Updated 3:02 PM CDT, Tue July 16, 2024

SAN FRANCISCO — Okta has announced new innovations that it says help organizations reduce their identity attack surface, stay ahead of evolving threats, and support financial services companies in securing and streamlining sensitive digital experiences.

According to Okta, identity has become the No. 1 attack vector in today's threat landscape. Over 80% of data breaches involve some kind of compromised identity - including legacy password compromises, privileged account takeovers, credential phishing and abuse, and stolen API keys.

Companies are also embracing multi-cloud and SaaS environments, with organizations deploying an average of 93 apps from various vendors globally. While this allows businesses to build a tech stack that best suits their needs, it also increases their attack surface. Currently, cybercriminals are 300 times as likely to target financial services companies than any other industry. With sensitive customer interactions vulnerable to fraud and subject to strict regulations, these companies require heightened security and privacy measures.

Companies are also embracing multi-cloud and SaaS environments, with organizations deploying an average of 93 apps from various vendors globally. While this allows businesses to build a tech stack that best suits their needs, it also increases their attack surface. Currently, cybercriminals are 300 times as likely to target financial services companies than any other industry. With sensitive customer interactions vulnerable to fraud and subject to strict regulations, these companies require heightened security and privacy measures.

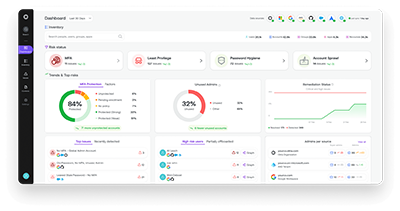

Okta's Identity Security Posture Management is a new product that proactively identifies vulnerabilities and identity security gaps. It helps companies continuously assess their Identity risk posture, uncover critical misconfigurations and gaps-like inconsistent MFA enforcement and account sprawl-and prioritize and remediate the most pressing issues based on risk severity.

"Identity is becoming increasingly complex with security teams lacking deep visibility and risk analysis in their different cloud and SaaS environments," said Arnab Bose, chief product officer, Workforce Identity Cloud at Okta. "With Identity Security Posture Management, companies now have an in-depth and near real-time view of their identity security risk, working as the first line of defense to discover gaps and reduce their attack surface."

Additionally, Highly Regulated Identity is now available for financial services companies in North America, Highly Regulated Identity is a solution suite on the Customer Identity Cloud that delivers financial grade identity with elevated security, privacy, and UX controls for sensitive customer interactions beyond login.

Built on financial industry regulations and standards, Highly Regulated Identity helps organizations navigate security and compliance for high-risk customer scenarios like updating account information, accessing open banking payment, and sending money - while meeting end-users' experience expectations.

"Across all industries, but especially highly regulated ones like financial services, it's difficult to deliver fast, intuitive, and secure digital experiences that drive customer loyalty," said Shiven Ramji, president of Customer Identity Cloud at Okta. "With Highly Regulated Identity, companies can satisfy consumers' need for instant gratification without sacrificing security."

Comments